Step 3: Add EmployeesĪfter you have entered your work location, a new window will appear that lets you add your employees’ basic information and payroll details into the system. It will also require you to enter the physical address where the majority of your employees work. You can also request detailed pay reports from your previous payroll provider.Īside from payments to employees in the current calendar year, the system will ask you to indicate the date that you plan to run your first payroll in QuickBooks. You can get YTD information from the last payroll you processed for each employee. Providing information about prior paychecks issued to employees before the beginning of your QuickBooks Payroll subscription is an essential step to ensure that your W-2 forms are accurate come year-end. Note that the system will require you to input year-to-date (YTD) payroll details and tax payments made for each employee later in the setup. Newly established businesses that have yet to run their first payroll can select “No” and then click “Next.”

#Quickbooks payroll tutorial free how to#

How to Manage Credit Card Sales With a Third-party Credit Card Processor How to Manage Credit Card Sales With QuickBooks Payments How to Reconcile Business Credit Card Accounts How to Manage Downloaded Business Credit Card Transactions

How to Enter Business Credit Card Transactions Manually Part 5: Managing Business Credit Card Transactions How to Handle Bounced Checks From Customers How to Transfer Funds Between Bank Accounts How to Manage Downloaded Banking Transactions How to Enter Banking Transactions Manually How to Set Up the Products and Services List How to Set Up Invoices, Sales Receipts & Estimates They provide one on one training, group QuickBooks live seminars, as well as training at your location or via the Internet.How to Customize Invoices, Sales Receipts & Estimates We’ll show you how this works.īring your toughest QuickBooks Payroll question, and if we don’t know the answer, we guarantee to hunt it down for you! Click the “Find a Trainer in your Area” tab above for information on a local QuickBooks expert in your area. Enhanced Payroll automatically fills in the latest federal and most state payroll tax forms for you – just print, sign, and mail. How to Handle Tax Forms – While Basic Payroll does not include any tax forms, you can easily generate reports and work with your accountant on tax filings.

#Quickbooks payroll tutorial free software#

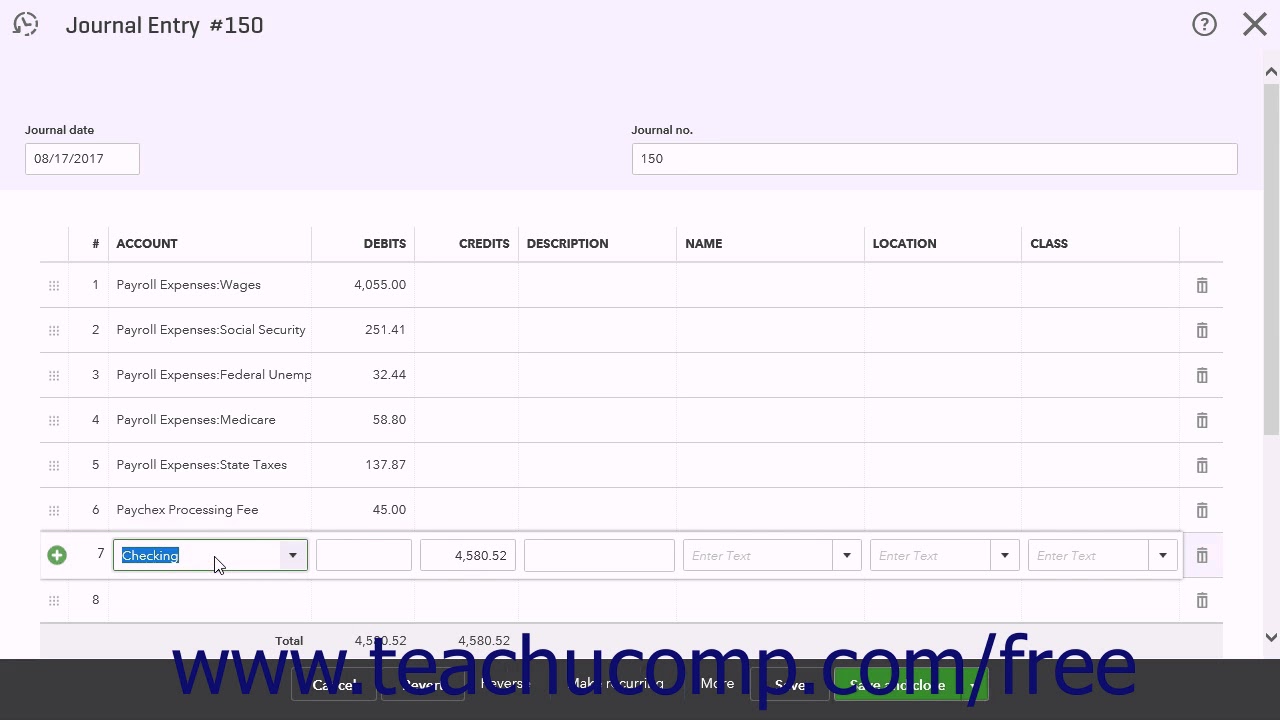

We’ll show you how to pay your federal and state payroll taxes electronically with E-Pay at no extra cost or how to write checks in the software to make the tax payments yourself.

We will teach you how to keep track of what you owe and how to set reminders of when and how much to pay. How to Use the “Calculate Payroll Taxes” Feature – QuickBooks Payroll will calculate federal and state payroll taxes for you. How to Print Paychecks and Use Direct Deposit – While there is an additional fee for direct deposit, we’ll walk you through the process. How to Pay Employees – Learn how to enter employee’s hours in QuickBooks and how the software calculates earnings, payroll taxes and deductions. Understanding the Difference between QuickBooks Basic Payroll and QuickBooks Enhanced Payroll –This brief section will help you determine which version is most appropriate for your firm.

0 kommentar(er)

0 kommentar(er)